Our Blog

Switching from QuickBooks?

3 reasons to choose a smarter Unified Business Application

Small and mid-sized businesses (SMEs) have until 30th April, 2023 to migrate from QuickBooks to an alternate software. Many businesses may have already moved to other Accounting only solutions. Few may be debating which application is best suited for the current stage of their business.

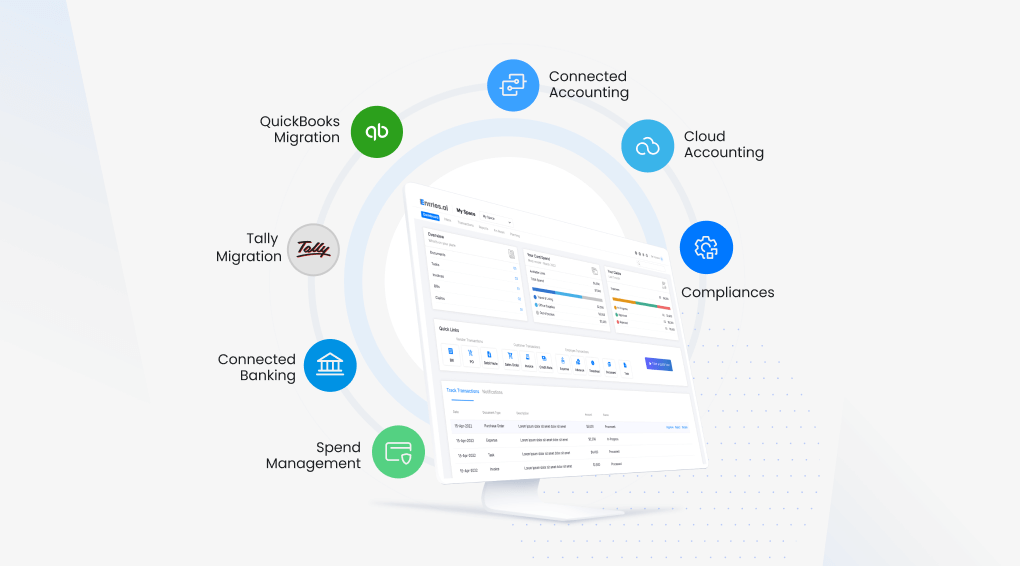

Whatever the scenario, a business must assess the merits of switching to a smarter unified business application over Accounting only solutions. A unified business application, by definition, should be a single-point system to manage core organisational functions. Take for instance, Entries.ai. It is an all-in-one Cloud Accounting application that integrates Accounts, Finance and Operations on one platform.

So, what are the benefits of switching to a Smarter Cloud Business Application?

-

1. Ease of Migration

Does your application enable swift migration of all data from QuickBooks? This should ideally include all data/file formats including COA, bills, invoices, journals, payments and even voucher attachments in one click. For instance, many leading Accounting softwares do not allow for migration of voucher attachments instantly from QuickBooks.

New-age Cloud Accounting business software such as Entries.ai have built-in workflows and audit trails that allow for swift migration of all data. In three simple steps, one can move all data from QuickBooks without breaking a sweat on speed, accuracy and anywhere, anytime access.

-

2. Beyond Connected Accounting

Wouldn’t it be nice if an application can go beyond tracking and managing accounts, expenses, taxes, compliances and financials, at a much lower cost than existing Accounting only solutions in the market?

Supplementary features that help businesses grow and scale while also earning from the application makes cents. A smarter business application will have an edge over other softwares. It will connect Accounts with the entire workforce, customers, vendors and bank on one single platform. It would also provide visibility and one source of truth into org-wide transactions to all stakeholders as per role based access. In short, it serves as a unified application throughout the startup-growth-maturity and exit stages of any startup or SME.

Entries.ai goes beyond Connected Accounting solutions to offer payroll and add-on features such as ONDC integration, API banking, Fintech products and services marketplace to name a few. SMEs can now grow their e-commerce business through the ONDC buyer-seller network. SMEs can also use the partner bank’s API, H-2-H and Connected Banking platform to access the bank’s products and services.

-

3. Automating e-invoicing, spends & compliances

Check to see if the application has functionalities such as auto-repeat for recurring invoices and direct upload to Invoice Registration Portal. Does it cross-check data inaccuracies instantly? Are multiple GSTIN transactions visible in real-time?

Is it possible to drag and drop employee expense receipts and create instant expenditure and reimbursement claims? Is there a customised dashboard to track cards and status of reimbursement claims? Can employees work anywhere, anytime on timesheets, projects, to-do lists etc.?

Does it help with timely audit, M&A, compliance tracking and collaboration with external auditors while providing a compliance health score?

The smart way to work is to make the application do all the work while you focus on growing the business. The smarter way to do business is to earn from the application while it does all the work for you. So, make your Accounting Application accountable for more than what you are told.

To know the entire features of a Smart Business Application on Cloud, download our free smart business application features checklist.